do you pay taxes when you sell a car in illinois

See Paperwork for Illinois Car Buyers above for tax form options. When you donate a car instead of.

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Illinois sales tax 625 is only paid at the time of purchase so if you gift a car worth 20000 you will save 1250.

. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Unless of course you. The tax rate is based on the purchase price or fair market value of the car. The buyer is responsible for paying the sales tax.

There is also between a 025 and 075 when it comes to county tax. Heres a vehicle use tax chart. You have to pay a use tax when you purchase a car in a private sale in Illinois.

A gift tax as defined by Investopedia is a federal tax applied to. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. 2nd St Rm 424 Springfield IL.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. You may need to pay the tax when gifting a car - a gift tax which depends on the fair market value of the car. Payment for fees and taxes.

If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax. - An Illinois State Trooper was hospitalized after his car was struck by a driver on I-55 early Friday in Cook County. In addition to state and county tax.

2 days agoIllinois State Police. You do not need to pay sales tax when you are selling the vehicle. The state sales tax on a car purchase in Illinois is 625.

Although unlike other states Illinois does not require a bill of sales. Instead the buyer is. The appropriate tax form.

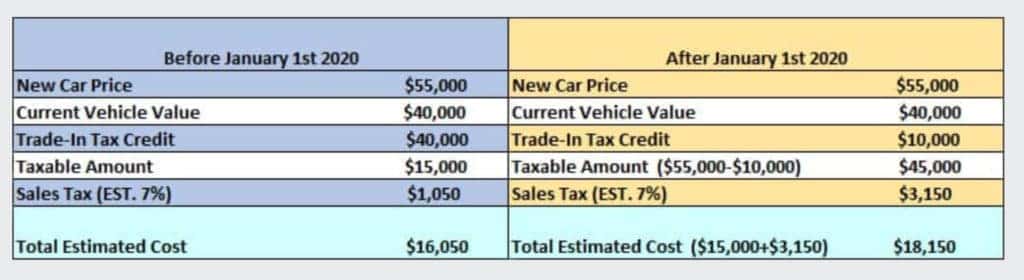

When the cap was in place you would only be exempt from 10000 regardless of how much your trade in was worth. Applications can be submitted in person at an Illinois Secretary of State facility or via mail to. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the.

Secretary of State Vehicle Records Processing Division 501 S. Thats 2025 per 1000. Zachary Morgan Zach Morgan is an insurance writer.

If your trade-in is valued at 4000 and the new car is valued at 22000 youll only pay sales tax on the difference18000 in this case. When you sell your car you must declare the actual selling purchase price. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

Therefore you will be required to pay an additional 625 on top of the purchase price of the vehicle. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Get a bill of sales.

This doesnt mean that you should neglect this document because it also helps relieve. Thankfully the solution to this dilemma is pretty simple. In the above example that would have been 30000.

It starts at 390. A bill of sale IF the required vehicle information is not on the title.

Illinois Vehicle Bill Of Sale Template Free Download Cocosign

How Do State And Local Sales Taxes Work Tax Policy Center

Illinois Trade In Tax Coming Chicago Il Marino Cdjr

Can You Drive A Car Without Plates When You Buy It In Illinois

States With No Sales Tax On Cars

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Illinois Will Suspend Tax On Groceries Delay Gas Tax Hike Here S Why

What Paperwork Do I Need To Sell My Car In Illinois Sell My Car In Chicago

Illinois Title Transfer Etags Vehicle Registration Title Services Driven By Technology

License Title Tax Info For New Cars Chicago Il Marino Cjdr

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Car Tax By State Usa Manual Car Sales Tax Calculator

Virginia Sales Tax On Cars Everything You Need To Know

Used Cars In Illinois For Sale Enterprise Car Sales

How Many Cars You Can Sell Without A Dealer S License Canadian Gearhead

Louisiana Car Sales Tax Everything You Need To Know

Illinois Bill Of Sale Forms And Registration Requirements

2020 Illinois Trade In Sales Tax Law Change Land Rover Hinsdale